Jeanne Dee Honored with UMSL Salute to Business Achievement Award

Jeanne Dee, CPA/CGMA, audit and assurance partner at Anders, will be honored by the University of Missouri –…

Read Full ArticleAt Anders, our team is always ready to help you succeed. Let's get started.

Contact AndersOur blog is an extension of the advice you receive every time you speak with one of our advisors. From industry and advisory trends to useful tax and audit resources and Anders news, you'll gain insights into what we do, who we are and how we can help.

If the pandemic has impacted you or your company, our COVID-19 Business Recovery advisors have the resources to help you go from surviving to thriving.

From industry-specific seminars to webinars on the latest tax, audit and advisory topics, Anders offers valuable events to help you and your business thrive.

February 13, 2024

Rob A. Kotsybar

April 26, 2024

Anders

Jeanne Dee, CPA/CGMA, audit and assurance partner at Anders, will be honored by the University of Missouri –…

Read Full Article

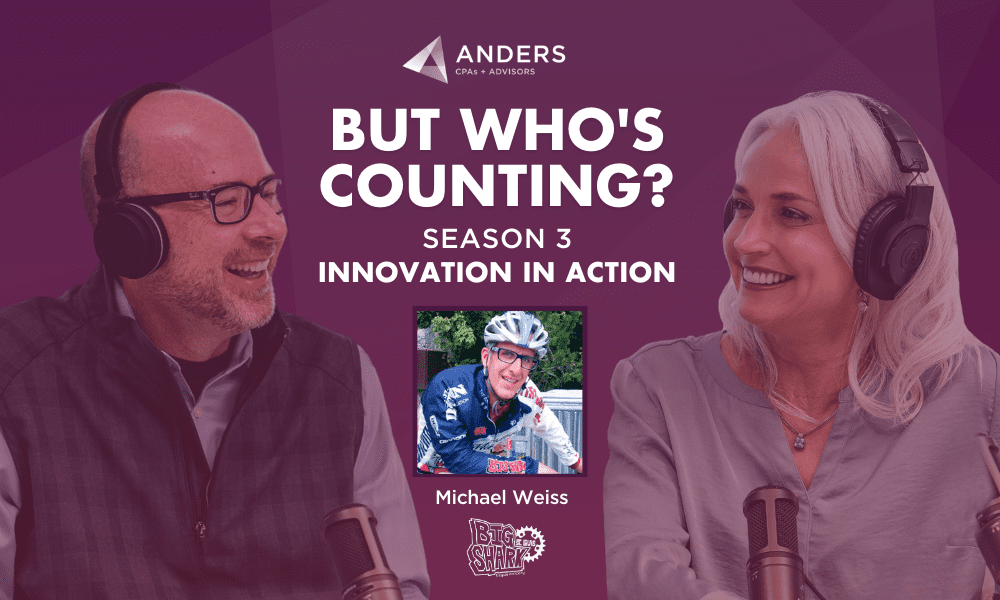

April 25, 2024

Anders

Artificial intelligence is continuing to advance at an exponential pace, mirroring the advent of the internet in some…

Play Podcast

April 23, 2024

Brittany M. Parker

The Tax Cuts and Jobs Act (TCJA) of 2017 was a major tax reform law that overhauled the…

Read Full ArticleWant to keep up with all the latest insights from Anders? Subscribe and receive the information that matters to you.

April 22, 2024

Anders

Thursday, June 27

Read Full Article

April 22, 2024

John C. Scott

As a service-based profession, law firms have to keep a careful eye on their production metrics: That means…

Read Full Article

April 18, 2024

Anders

The University of Missouri’s Robert J. Trulaske, Sr. College of Business faculty have selected Daniel K. Schindler, CPA,…

Read Full Article

April 17, 2024

Anders

University of Missouri alumnus and longtime supporter Craig Campbell, CPA/CGMA, Tax Partner at Anders CPAs + Advisors, was…

Read Full Article

April 17, 2024

Guillermo Rodriguez

Aaron Smith, CEO of the National Cannabis Industry Association (NCIA), joins Guillermo to discuss the impact of potential…

Read Full Article

April 16, 2024

Cameron S. Thomas

Missouri Senate Bill 190, signed into law by Governor Mike Parson in 2023, aims to provide tax relief…

Read Full Article

April 15, 2024

Jody A. Grunden

When we talk growth with digital agency owners, we don’t just look at financial metrics. Instead, we focus…

Read Full Article

April 12, 2024

Anders

Anders was named as a finalist for the 2024 Corporate Philanthropy & Innovation in Philanthropy Awards in the…

Read Full Article

April 9, 2024

Anders

After an intense NCAA tournament, Mark Sweeney crafted the winning bracket in the 36th annual Anders Hoops for Hope…

Read Full Article

April 9, 2024

Lance C. Warren

Ohio House Bill 33 has resulted in favorable changes to the Ohio Commercial Activity Tax (CAT), which began…

Read Full Article

April 3, 2024

Guillermo Rodriguez

In this episode, Guillermo is joined by Seth Yakatan of Katan Associates for a freewheeling conversation. They discuss…

Read Full Article

April 2, 2024

Anders

As startups continue to feel the effects of venture capital pulling back their investments, they still require funding…

Read Full Article

April 1, 2024

Kim S. Moore

The latest Department of Labor (DOL) Audit Quality Study reveals that 401(k) audits are increasingly specialized, requiring businesses…

Read Full Article

April 1, 2024

Dan L. Rutherford

Every industry goes through down cycles, transportation and logistics included: After the pandemic freight boom, we’ve seen gas…

Read Full Article

March 27, 2024

Brad R. Stumpe

Banks of all sizes should be familiar with the evaluation standards under the Retail Lending Test, which will…

Read Full Article

March 27, 2024

Anders

Face your Retail Lending Test with confidence backed by to-the-minute research on an evolving regulation. The new Retail…

Read Full Article

March 27, 2024

Guillermo Rodriguez

In this episode, Guillermo is joined by Wendy Campbell, VP of Sales at the premier cannabis event, MJ…

Read Full Article

March 26, 2024

Merella Schandl

The importance of data management in health care environments can’t be overstated. Especially during complicated processes like credentialing,…

Read Full Article

March 25, 2024

John C. Scott

Cash flow management is a lot like a road trip: If you want to know the answer to,…

Read Full Article

March 22, 2024

Guillermo Rodriguez

Welcome to the 1st episode of the CannaBiz Success Show! In this inaugural episode, Guillermo welcomes Pat Helmers,…

Read Full Article

March 20, 2024

Anders

St. Louis startups and their funding sources are an integral part of the city’s revitalization as they bring…

Read Full Article

March 19, 2024

Anders

Anders is proud to be recognized as one of Accounting Today’s Top 100 Firms for the fourth year…

Read Full Article

March 19, 2024

Paul C. Rhea

Although many Coronavirus Aid, Relief and Economic Security (CARES) Act programs have come to an end, they continue…

Read Full Article

March 18, 2024

Dan L. Rutherford

Operating a business in the trucking industry has always been a challenge, but recent years have been exceptionally…

Read Full Article

March 12, 2024

Patrick C. Peters

With the unprecedented, rapid rise in interest rates, financial institutions must grapple with the growing impact on commercial…

Read Full Article

March 11, 2024

Guillermo Rodriguez

Cannabis entrepreneurs face major challenges when it comes to business financing. Even as recreational use becomes more common…

Read Full Article

March 5, 2024

Douglas D. Mueller

The Corporate Transparency Act (CTA) has been declared unconstitutional by an Alabama court, putting the newly finalized law…

Read Full Article

March 5, 2024

Jason N. Gotway

Next-generation software can help detect cyber attacks, but a managed detection and response (MDR) strategy marries human expertise…

Read Full Article

March 4, 2024

John C. Scott

Contingent fee attorneys often feel like law firm forecasting is out of reach. There are so many question…

Read Full Article

February 28, 2024

Dan L. Rutherford

The trucking industry is a backbone for economies worldwide, but trucking business owners know well that the accounting…

Read Full Article

February 27, 2024

Erin E. Mueller

Filing taxes for a deceased person, whether it’s a parent, spouse or other loved one, may seem like an…

Read Full Article

February 22, 2024

Anders

When a company is thriving, no one wants to think about potential roadblocks or dangers ahead. But when…

Play Podcast

February 20, 2024

Jeff Milam

The process of determining the value of an agency is a crucial step for any current owner, potential…

Read Full Article

Want to keep up with all the latest insights from Anders? Subscribe and receive the information that matters to you.