Understanding Cannabis Funding and Accessing Capital with Adam Stettner

Adam Stettner, CEO of FundCanna, joins Guillermo to discuss the financial challenges faced by small businesses in the…

Read Full ArticleWork with a dedicated Virtual CFO and team of accountants, CPAs and tax professionals to help your business accelerate growth, navigate change and achieve success.

At Summit Virtual CFO by Anders, we offer comprehensive financial reporting, forecasting and a variety of tax services that give you deeper levels of insight into your business, ultimately creating a roadmap to reach your professional goals. A dynamic forecast based on solid non-financial drivers will help you manage cash flow, increase revenue and strategize for long-term growth. Our experienced CFOs focus on profitability and growing cash to sustain your business operations.

Our Virtual CFO Service may be a perfect fit for you if:

Your business has reached over $2 million in annual revenue.

Your company has grown to the point that you need professional financial advice but can’t yet afford a full-time CFO or controller.

You’re looking to replace an existing CFO and don’t need an on-site CFO on a daily basis.

You need strategic support, at an affordable, fixed rate.

Our process starts with onboarding. Our team works hard during onboarding to get caught up with your existing processes. We look at your past books, build a forecasting model and set of KPIs, and perform a detailed review of your financial statements/chart of accounts to make sure we’re all on the same page and getting started on the right foot. Note: During the onboarding period, our normal weekly fee is doubled to cover the additional resources and effort needed to get up to speed in a timely manner.

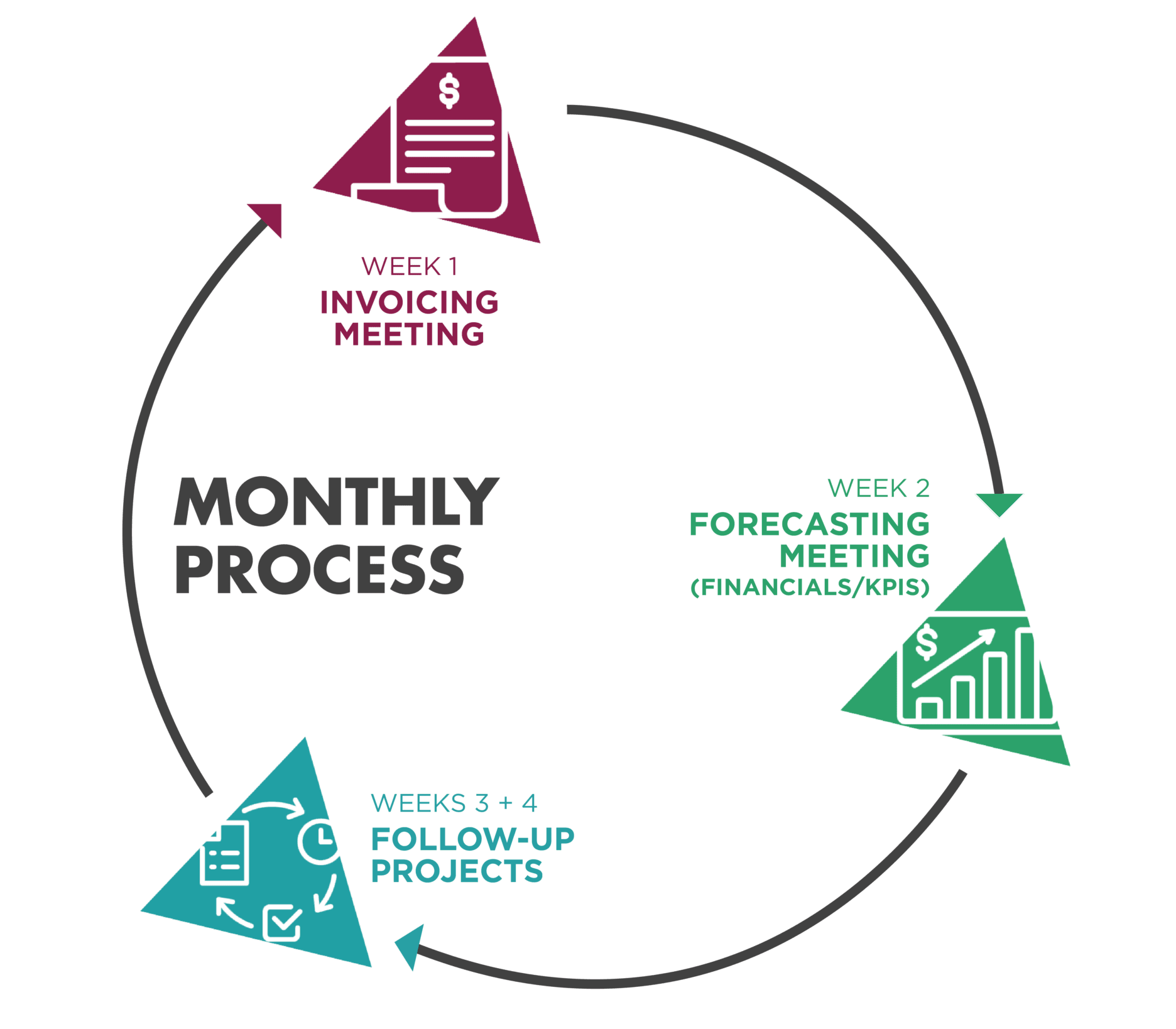

How we work together after onboarding: Each service level has a different meeting cadence. After an initial onboarding period, a typical month might include:

If we are paying bills as part of the engagement, we will also meet weekly with one individual team member for about 15-30 minutes to go over cash flow for the next six to 13 weeks. We find that this schedule works best for most clients, but it is tailored to fit your needs. Regardless of the level of service you choose, we are always available anytime for questions, calls, and impromptu meetings.

Our pricing policy is fixed. Your quote is not an estimate.

We learn what you need and use specific criteria to itemize an all-encompassing price. There are no hidden costs or miscellaneous fees. Your price won’t change unless you choose to change service levels or add à la carte options.

We price weekly because we are not a traditional accountant that you see once per quarter. And we’re not simply another vendor. Your employees don’t increase their rates, and they don’t charge you every time you ask them a question. Neither will we. We’re an extension of your team, and we want you to treat us that way!

*The average price scales based on revenue and employee count. Final pricing takes into account these factors and a la carte services added on by the client. Pricing has been updated as of 2/21/2023.

Ideal for small businesses with fewer than 10 employees, our Transactional package provides the essential financial services you need. Get access to our leading-edge tech stack, a remote accounting team, and unlimited online support. We handle your month-end close and provide financial statements to keep your business on track.

Designed for medium-sized businesses with 10-20 employees, our Controller package offers proactive financial services. In addition to the Transactional package services, you’ll benefit from company-wide KPIs, 12-month forecasting, and revenue recognition. We also offer up to 2 scheduled meetings per month for detailed financial discussions.

Ideal for larger businesses with 20+ employees and $5 million+ in annual revenue, our Virtual CFO package partners you with a Virtual CFO for forecasting, risk reduction, and profit increase strategies. Enjoy comprehensive financial services, performance tracking, and weekly leadership meetings.

New and growing businesses can’t always afford a full-time CFO. Hiring a full-time CFO averages $229,000 per year. That doesn’t include vacations, bonuses and other benefits. This cost can be significant for new and growing businesses. Not to mention, not every business needs or is ready to bring on a CFO. There’s a better way!

Summit Virtual CFO by Anders is a virtual CPA solution where you can outsource your CFO and accounting needs. Our Virtual CFOs provide many services including: managing bank relationships, weekly meetings, business forecasting, company-wide KPIs and more, all at a fraction of the cost of a full-time team member. Our average Virtual CFO package costs $78,000 per year.

Download a copy of our Virtual CFO Services guide to learn more about our processes, how we work with clients and more.

Download our Virtual CFO Services Guide

How much does a Virtual CFO cost? When is it time to hire a Virtual CFO? Our free consultation will help you get the answers you need so you can decide how and when to move forward.

Want to keep up with all the latest insights from Anders? Subscribe and receive the information that matters to you.