Few industries were as deeply impacted by the coronavirus pandemic as the restaurant industry. CARES Act programs have assisted many struggling businesses on their road to recovery, but a post-COVID economy is proving to be just as difficult to navigate as the pandemic itself.

We covered many of the issues currently facing the restaurant industry in a recent episode of our podcast, But Who’s Counting? Our advisors discussed vital information that restaurant owners need to know, especially if they took part in or still plan to use government aid released to those affected by the pandemic.

There were several programs throughout the pandemic to aid businesses negatively impacted by the coronavirus pandemic, including Employee Retention Tax Credits (ERTC), Economic Injury Disaster Loans (EIDL), and Restaurant Revitalization Funds (RRF). Each program came with its own requirements and restrictions. Below we dig into what’s next for these programs and guidance for those who benefitted.

ERTC for Restaurants

Important ERTC Takeaways:

- Still applicable to 2020 and 2021 taxes

- No application necessary, simply file an amended payroll tax return

- Strong chance for an IRS audit within 5 years

- ERTC can increase businesses’ taxable income

- Tip wages also count towards ERTC

While the time limit has passed to apply for EIDL or Restaurant Revitalization funds, qualified businesses can still recoup some tax savings for both 2020 and 2021 with ERTC. Initially, businesses had to decide between applying for Paycheck Protection Program (PPP) loans and ERTC, but an expansion of the program under the American Rescue Plan Act of 2021 allowed both programs to be utilized in conjunction with each other.

There are many benefits to the ERTC program, including more freedom with using the funds than was allowed with PPP loans. In that case, the funds provided had to be applied towards payroll tax, but ERTC is a true credit that can be used however the owner decides.

The ERTC covers the period between when the coronavirus pandemic was first announced in March of 2020 all the way through at least the third quarter of 2021, although in other cases it can go until the fourth quarter. Businesses can retroactively recoup tax savings from those years per employee, though the amounts do vary.

How ERTC Funds Are Calculated

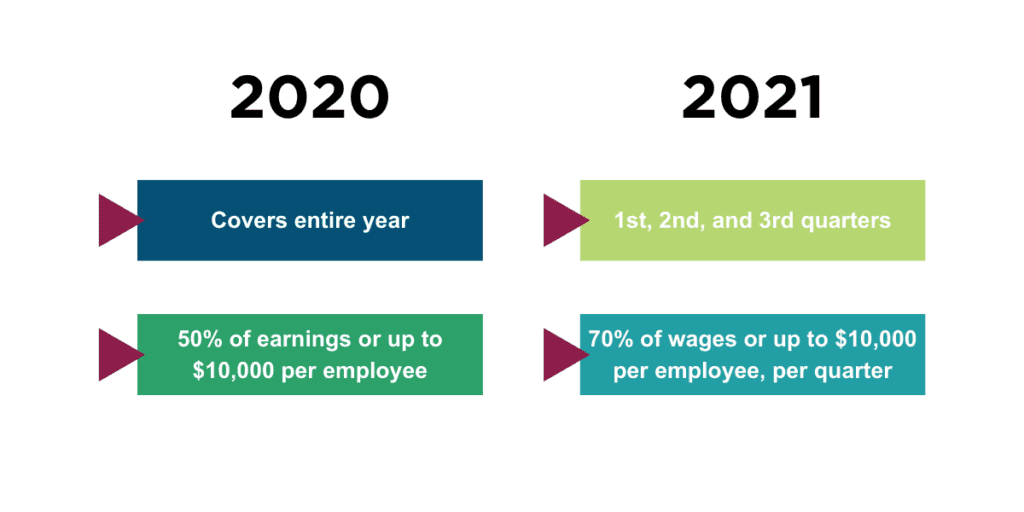

For tax year 2020, businesses can receive up to 50% per employee, or up to $10,000 each, for the entire year.

For tax year 2021, the tax savings are much more generous and lucrative. The tax credit for 2021 covers up to 70%, or up to $10,000 in wages per employee per quarter. In other words, if you paid an employee $10,000 during the first, second and third quarters of 2021, your business could be eligible for as much as $21,000 in tax credits.

Where this tax credit proves to be extra advantageous for restaurants is the fact that tips are also considered covered under this program, meaning an extra cushion of savings for restaurants specifically.

How to Qualify for the ERTC

To qualify for the tax credit, businesses had to have experienced a complete or partial shutdown during the pandemic. A partial shutdown may refer to limitations placed on businesses that impacted their ability to operate as usual. For instance, limitations on how many people could enter the location at a time or six-foot social distancing rules.

To claim the ERTC, businesses simply need to file an amended payroll tax return for 2020 and/or 2021. There’s no additional application process or forms that must be submitted with those amended payroll tax returns, but keep in mind that there is a high probability that they will later be audited by the IRS. The IRS has already announced that they have extended the statute of limitations for going back and auditing those 941 forms claiming the ERTC by two years, taking the statute from three to five years.

There’s a lot of gray area here, which is why it’s recommended that businesses use a CPA or advisor knowledgeable in coronavirus pandemic programs to make sure they qualify. It’s especially important since the ERTC counts as taxable income, which is why it’s wise to have an advisor who can not only help you get started on the process but explain what’s going to happen next.

Restaurant Revitalization Funds Next Steps

RRF Takeaways:

- Eligible expenses must be submitted to the SBA by March 11, 2023

The time to collect on Restaurant Revitalization Funds has already passed, but if your business qualified and you received funds, you may still have more to do to qualify for full forgiveness. It’s imperative that businesses who have taken RRF money submit their eligible expenses to the Small Business Administration (SBA) by March 11, 2023. Annual expense reports will need to be submitted as well.

EIDL Funds – Vital Difference Between EIDL and PPP

EIDL Fund Takeaways:

- Not a forgivable loan, must be paid back

- Strict rules limit expansion, owner enrichment

- Breaking loan agreement could result in paying 1.5 times the loan amount

Once the pandemic was declared a national disaster, every business became eligible for the EIDL program. These loans, unlike PPP loans, are not forgivable and must be paid back. To make up for that fact, the terms of these loans are incredibly favorable for the borrower, but they come with strict stipulations.

A business who has received EIDL funds can’t overly enrich the owner, nor is the business allowed to expand. It’s vital that those who received EIDL loans check the fine print on those agreements to make sure they’re following guidelines to a tee, since non-adherence to the rules is expensive. If your business doesn’t follow the terms of this loan to the letter, you could be stuck paying 1.5 times the loan amount.

Let’s say you borrowed $100,000. If you made the mistake of using those funds to open a second location of your restaurant, you could be stuck repaying $150,000 instead. That’s an extra expense no business wants to deal with, which is why an experienced CPA might be needed to guide you through the process.

Our team of CPAs and advisors assist businesses in the lodging, food and beverage industry add value through tax strategies and financial advice. Learn more about how we can help you by contacting an Anders advisor below.