CARES Act Relief Radar: IRS to Resume ERC Payments on Low Risk Claims – But Beware of ERC Advance Loans

Although many Coronavirus Aid, Relief and Economic Security (CARES) Act programs have come to an end, they continue…

Read Full ArticleAt Anders, our team is always ready to help you succeed. Let's get started.

Contact AndersOur blog is an extension of the advice you receive every time you speak with one of our advisors. From industry and advisory trends to useful tax and audit resources and Anders news, you'll gain insights into what we do, who we are and how we can help.

If the pandemic has impacted you or your company, our COVID-19 Business Recovery advisors have the resources to help you go from surviving to thriving.

From industry-specific seminars to webinars on the latest tax, audit and advisory topics, Anders offers valuable events to help you and your business thrive.

July 11, 2024

Paul C. Rhea

Although many Coronavirus Aid, Relief and Economic Security (CARES) Act programs have come to an end, they continue…

Read Full Article

July 2, 2024

Paul C. Rhea

The Internal Revenue Service (IRS) plans to resume payments on older, low-risk Employee Retention Tax Credit claims, otherwise…

Read Full Article

October 27, 2023

Daniel K. Schindler

After announcing an immediate moratorium on processing new Employee Retention Tax Credit (ERTC) claims, the IRS has issued…

Read Full ArticleWant to keep up with all the latest insights from Anders? Subscribe and receive the information that matters to you.

September 15, 2023

Sean McKenzie

The IRS issued a moratorium on processing new Employee Retention Tax Credit (ERTC) claims on September 14, 2023.…

Read Full Article

March 7, 2023

Brent E. McClure

Do banks qualify for the Employee Retention Tax Credit, often referred to as the ERTC or ERC? The…

Read Full Article

November 15, 2022

Daniel K. Schindler

The restaurant industry was hit especially hard by the coronavirus pandemic and though government programs like RRF and…

Read Full Article

October 11, 2022

Daniel K. Schindler

Few industries were as deeply impacted by the coronavirus pandemic as the restaurant industry. CARES Act programs have…

Read Full Article

October 6, 2022

Paul C. Rhea

The recent interest rate hikes from the Federal Reserve may have some business owners concerned about their future…

Read Full Article

July 19, 2022

Sean McKenzie

The Employee Retention Tax Credit (ERTC) is gaining more and more attention as companies are discovering that they…

Read Full Article

June 28, 2022

Sean McKenzie

The Employee Retention Tax Credit (ERTC) has helped many businesses retain employees and recover from the effects of…

Read Full Article

December 14, 2021

Rebekah J. Tucker

As a follow-up to our recent Not-for-Profit Symposium, we’re revisiting how not-for-profits can utilize remaining funds given out…

Read Full Article

December 8, 2021

Zachary McDowell

The Employee Retention Tax Credit (ERTC), originally a part of the Coronavirus Aid, Relief, and Economic Security (CARES)…

Read Full Article

October 26, 2021

Joshua L. Snyder

Originally part of the CARES Act, the Employee Retention Tax Credit (ERTC) helped businesses stay open through the…

Read Full Article

September 1, 2021

Daniel W. Mudd

Demand for wood products increased during the pandemic and combined with supply chain disruptions resulted in shortages and…

Read Full Article

June 22, 2021

Laura Long

The $16 billion Shuttered Venue Opportunity Grant (SVOG) program was created to offer much-needed COVID-19 relief to entertainment…

Read Full Article

June 8, 2021

Anders

Updated 6/22/21 The American Rescue Plan Act (ARPA) signed into law in March expands the Child Tax Credit…

Read Full Article

May 7, 2021

Anders

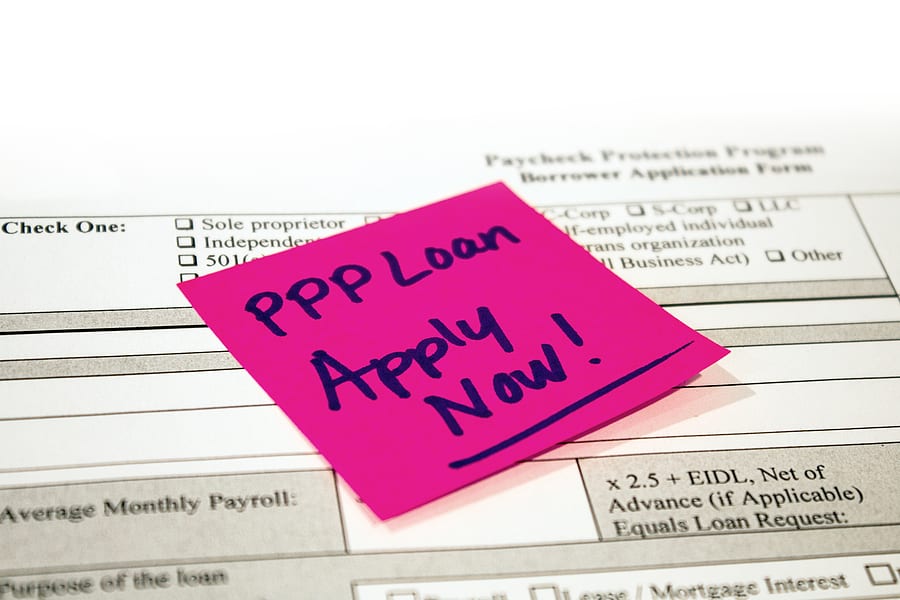

With new updates and legislation evolving quickly around the Paycheck Protection Program (PPP), our CARES Act Research and…

Read Full Article

May 4, 2021

Anders

The American Rescue Plan Act (ARPA) was signed into law on March 11, 2021, offering many pandemic relief…

Read Full Article

April 20, 2021

Anders

As the world begins to recover from 2020 and the economic detriment, what is next on the horizon? Download…

Read Full Article

April 20, 2021

Daniel K. Schindler

In an effort to help restaurants and bars recover from the financial impacts of COVID-19, $28.6 billion of…

Read Full Article

April 13, 2021

Carl J. Toler

A key part of the Coronavirus Aid Relief and Economic Security (CARES) Act, the Paycheck Protection Program (PPP)…

Read Full Article

April 6, 2021

Robert L. Berger

The Employee Retention Tax Credit (ERTC) has been a valuable COVID-19 relief option for businesses who faced revenue…

Read Full Article

March 30, 2021

Paul C. Rhea

President Biden recently signed a bill to extend the Paycheck Protection Program (PPP) application deadline to May 31,…

Read Full Article

March 25, 2021

Paul C. Rhea

The SBA recently announced an expansion to the Economic Injury Disaster Loan (EIDL) program for small businesses and…

Read Full Article

March 25, 2021

Daniel K. Schindler

Updated 4/26/2021 As part of the Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act signed into…

Read Full Article

March 19, 2021

Zachary McDowell

On March 11, President Biden signed into law the American Rescue Plan Act of 2021 (ARPA). This relief…

Read Full Article

March 18, 2021

Douglas D. Mueller

The IRS has officially extended the federal individual income tax filing and payment deadline from April 15 to…

Read Full Article

March 11, 2021

Paul C. Rhea

The highly-anticipated $1.9 trillion COVID-19 relief package known as the American Rescue Plan Act of 2021 has been…

Read Full Article

February 22, 2021

Paul C. Rhea

New changes to the Paycheck Protection Program (PPP) were announced by President Biden on February 22. These tweaks…

Read Full Article

February 16, 2021

Daniel K. Schindler

A second round of Paycheck Protection Program (PPP) loans brings many questions around funding eligibility and how the…

Read Full Article

January 28, 2021

Anders

The newly expanded Employee Retention Tax Credit (ERTC) and second draw of the Paycheck Protection Program (PPP) has…

Read Full Article

January 19, 2021

Julia A. Deien

Now is a perfect time to review your technology plan and assess how cloud technology can help your…

Read Full Article

January 19, 2021

Jason N. Gotway

Round two of the Paycheck Protection Program (PPP) is upon us and Anders has been closely analyzing the…

Read Full Article

January 15, 2021

Jeanne M. Dee

The Not-for-Profit sector has finally received some good news as it relates to COVID relief and the new…

Read Full Article

January 8, 2021

Anders

Download our recorded webinar to find out how the $900 billion package will provide much-needed COVID-19 relief for families, businesses…

Read Full Article

January 5, 2021

Abby Ferguson

The $2.3 trillion Consolidated Appropriations Act of 2021 was signed into law on December 27, 2020 bringing much-needed…

Read Full Article

Want to keep up with all the latest insights from Anders? Subscribe and receive the information that matters to you.