The recent interest rate hikes from the Federal Reserve may have some business owners concerned about their future growth and profit margins, but with careful planning and the right advisors by your side, companies can get through this and possibly come out even stronger on the other side.

Key Takeaways

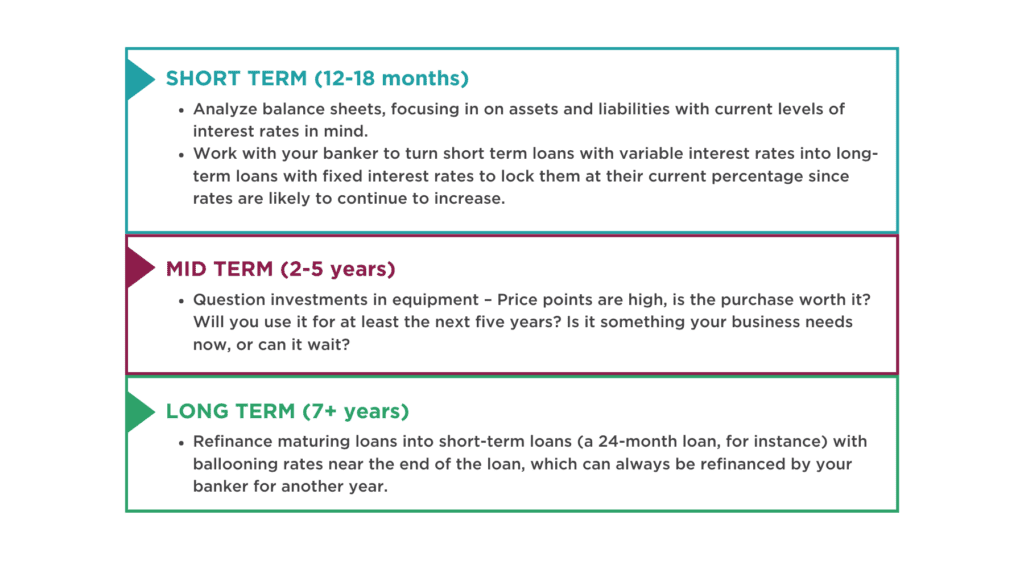

1) Although rising rates may be short lived, businesses should always have projections for a period of five years to allow for any adjustments.

2) Within that five-year plan, you should incorporate a short-, mid-, and long-term plan to guide your business.

3) Understand how your plan to protect profit margins will affect consumers, employees and yourself.

In a recent webinar for HireLevel, we covered some tips and tricks on how to adjust to a high interest rate and inflation environment, including the best ways to protect profit margins, advice on what to do with debt, and how to manage increasing inventory acquisition costs.

Inflation’s Impact on Interest Rates

While higher than normal inflation and rising interest rates are affecting a variety of businesses, those with less than 17-18 years of experience haven’t dealt with this level of rising interest rates. Thanks to high inflation, 9.1% as compared to the Fed’s preferred 2% yearly increase, interest rates are on the rise and it’s unlikely that there will be a drastic decrease in those rates for the foreseeable future.

The Federal Open Market Committee raised interest rates by 75 basis points during their July meeting and as expected, they once again raised rates at their September 20-21st meeting. Some bankers are estimating that the prime interest rate could hit over 7% by the end of the year 2022.

When Will Interest Rates Drop?

While the experts agree that high interest rates won’t stick around forever, there is a consensus that businesses should expect these higher rates to continue rising this year and perhaps even into 2023. Hopefully by 2024, those rates should begin to stabilize, though you won’t see them reach pre-pandemic levels for some time. Geopolitical events could also impact global inflation rates, as is happening now with the ongoing conflict in Ukraine.

If inflation remains high, interest rates will as well, and it’s highly unlikely that you’ll see a drastic drop in inflation anytime soon. It’s prudent for business owners to expect interest rates to either continue rising or remain at a higher level for at least the next two to three years. Ideally, business owners should factor in these higher interest rates into their business planning for five years.

How to Protect Your Interests During a Rising Rate Environment

Protecting profit margins is key when facing rising levels of inflation. There are several ways to do so, but keep in mind that not everyone, including business owners, employees and possibly even consumers will be completely happy with the process. Reducing inventory and cutting costs, including marketing, entertainment and salaries, are two ways to manage inflation. When reducing inventory, it’s not usually advisable to sell overstock off to secondary markets, resulting in a loss. Instead, consider ordering less product.

Some businesses have chosen to reduce size and quantity offered to the consumer while keeping prices the same. For instance, if you have visited a fast-food restaurant lately you may have noticed that the “small” sized drinks are now much smaller than their usual size, but still the same price. While the consumer likely won’t be terribly pleased, this is one way companies can help protect profit margins.

Raising prices on products is another way to make up for inflation. While customers may experience a bit of sticker shock initially, there’s a chance that your business can keep those prices even after inflation comes back down, leading to increased margins. For most companies, the effects are short lived but can help you to get through a tricky financial period.

Frequently Asked Questions around Rising Interest Rates

Should I quit growing until rates get better?

Can you find employees? Is your business struggling? Many businesses rely on continued growth to survive and thrive. Times like these are sometimes considered “millionaire makers,” as those who make it through the tough periods often come out more successful than ever before. There are some caveats, however. EIDL funds may limit growth and other stimulus packages require business owners not to move forward with growth and expansion while the loan is outstanding.

Should I hold off purchasing the building I really need for a couple of years?

Building prices are about as high as they’ve ever been. A long-term mentality here is key, so look 15 years to the future to make sure this is the best possible decision for your business. If the financing options are favorable, and you need a new building, you probably won’t want to hold off on purchasing.

Should I drastically reduce inventory and pay off debt?

Selling off inventory at a loss isn’t ideal, even if it results in paying off some debt. Instead, consider ordering less inventory and using those savings to pay down debt.

Should I refinance now, taking a higher rate, because I have a hard maturity in the next year to 24 months and it will be higher?

Typically, yes, but it’s always best to check with your banker or advisor concerning your own individual circumstances. In a few years, when these refinanced loan terms may be coming to an end, the interest rates are going to be completely different as we’ll likely be heading towards a reducing or leveling out environment rate-wise. It may feel counterintuitive, but aggressive problem solving early on can lead to favorable outcomes for those bold enough to try.

Reminder: this interest rate environment is a short-term situation. Within 24 months, we could be seeing an entirely different landscape with interest rates leveling off or even dropping. Although some government programs meant to help businesses through the pandemic have ended, there are still programs like the Employee Retention Tax Credit (ERTC) which are still available for qualifying businesses.

Our advisors will continue to monitor the Federal Reserve’s interest rate strategy to provide up-to-date insight to businesses. Learn how we can make a difference for your business by contacting an Anders advisor below.