Cash flow management is a lot like a road trip: If you want to know the answer to, ‘Are we there yet?’ you need to start with a destination in mind. In cash flow management, we call that a target, and it generally needs to be somewhere between 10-30% of annual revenue, depending on the size and type of your law practice and the length of your cash cycle.

Setting a cash target for your legal practice is like deciding how much extra fuel to carry in your car. Some of it depends on your firm – its size, type and client-makeup, its partner demographics, and its billing practices. Some of it depends on your destination – whether you’re trying to grow and scale, and at what speed. Some of it depends on external factors that you won’t be able to control, like the economy, but that you’ll want to take provisions to handle.

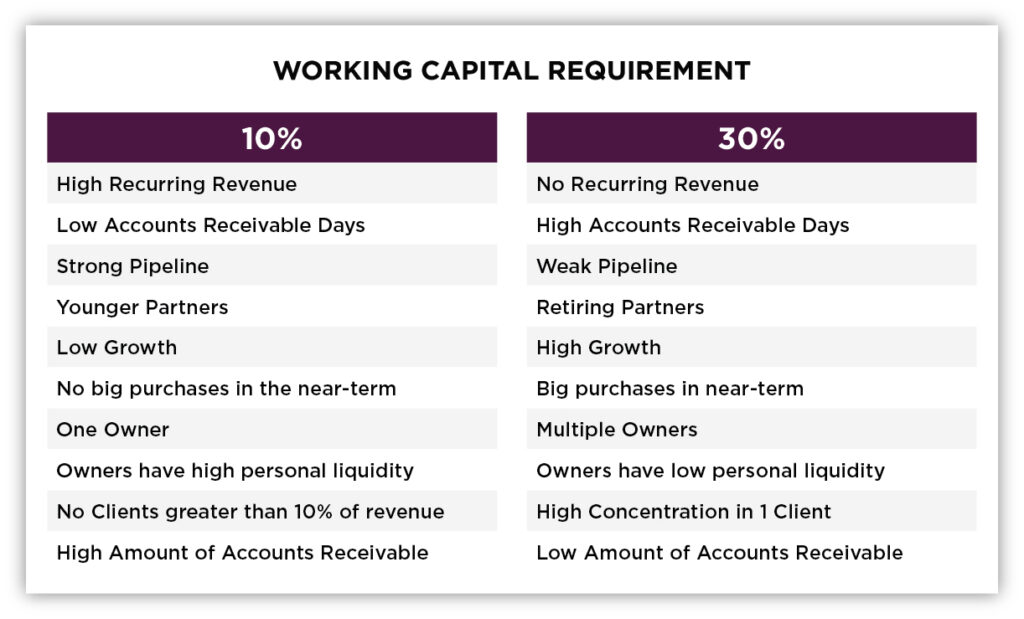

Every firm will have their own cash target, but here are guideposts we recommend:

On the 10% end of the spectrum, you’ll have:

- Firms that bill hourly and have good billing processes with a short cash cycle. They can convert effort into cash relatively quickly.

- Firms that have regular annuity work

- Firms that have a diverse client roster

- Firms that have high accounts receivable

On the 30% end of the spectrum, you’ll have

- Contingent fee firms

- Firms with less-than-ideal billing hygiene and/or a long cash cycle

- Firms that do one-time project work

- Firms with high concentration in a single client (more than 10% of revenue)

- Firms in a high growth phase

- Firms with low accounts receivable

- Firms with partners close to retirement

A lot of variables go into this decision. Even after you set – and reach – a target, you’ll have to revisit the decision regularly as your firm’s characteristics and goals shift.

Managing cash flow is an on-going task. If your revenue increases, you have to increase your working capital to stay on target with the percentages, and there are only three ways to do that: partner contributions, a draw on the line of credit, and not distributing all profit. Of the three, we prefer leaving cash behind from profit. That means that an “extra” $100,000 in the bank isn’t all available for distribution: You’ll have to set aside a larger amount for taxes, then some will go to increasing working capital, and then the remainder will go into your pocket – usually on a quarterly basis. It’s having an understanding of cash flow that allows you to make those bigger moves with confidence.

Optimize Cash Flow: Mistakes Every Law Firm Should Avoid

Once you have a target, you need to put certain best practices into place to make sure you stay on track and avoid cash flow issues in the future.

Cash flow problems tend to come from one of these five mistakes. Here are tools and strategies to help overcome them.

Mistake #1: Using One Bank Account for Multiple Purposes

Solution: Have an operating account, a cash reserve account, a tax account, and a client trust account.

Operating account and cash reserve: You’ll want to set up two accounts for your working capital: an operating account and a reserve account.

The operating account should cover two payrolls. It’s an easy number to remember. This is more of a rule of thumb than a specific calculation.

The reserve account should house your remaining monies (hopefully earning interest along the way). Money will move back and forth from this account: If money is needed in the operating account, money can be moved into that account and then back again when necessary. The reserve account should be saved in a money market or high interest savings account, that way money can still be accessed easily, but you are earning interest off your deposits. If you would like to get a little aggressive with your reserve account, spend no more than 10% of your cash reserve in aggressive stocks or bonds.

Client trust account: When you take possession of client money, such as settlements or retainers, this account is required to segregate and account for their funds. It’s a mirror image of your client retainer liability account on your balance sheet. However big this number is, don’t get too excited: This is not your money until it’s earned, at which point it moves into your general cash account (and moves from the liability section of your balance sheet to the income statement as fee income).

Tax account: You’ll want extra money set aside to distribute quarterly for partner taxes, as we discuss below.

Mistake #2: Taxes? What Taxes?

Solution: Set aside 40% of your forecasted taxable income and make estimated quarterly payments.

There’s no reason there should be big surprises come tax time. To prepare for the year ahead, you’ll want to save 40% of your forecasted taxable income in a separate tax account, over and above the 10 percent to 30% that you have in the cash reserve. The reason we recommend keeping your tax money in a separate account is because it’s out of sight, out of mind. If that money were kept in your operating account, it could create a false sense of security.

Money should go in your tax account on a weekly or monthly basis based on your forecast, and then pulled out of the account on a quarterly basis. The amount that is pulled out each quarter is based on your estimated taxes for the prior year. At the end of the year, it’s important not to pay too much to Uncle Sam because once you do, you can’t get it back until April 15th. At the end of the year, you should have enough money left in your tax account to make your April 15th payment.

Mistake #3: Blurring duties for reconciling books

Solution: Use three different people to issue/record, review and reconcile payments.

When you run a small firm, it can be easy to let the same people wear too many hats, which leads to mistakes, mismanagement and, in the worst case, fraud. That’s why the best cash flow practices involve three different people to handle each phase of the process:

- A bookkeeper to prepare disbursements and receive payments

- A managing partner to review and approve duplicate statements

- A third-party to reconcile the accounts

Overseeing cash receipts, cash disbursements, recording and reconciling is a lot of work. If one or two people do it all (on top of their additional duties), they are less likely to be timely with their financial reporting. In addition to preventing the rare instance of fraud, separation of duties divides the workload and allows each person in the process to do what they do well – and do it in a timelier manner.

Mistake #4: Poor Billing Hygiene

Solution: Enforce billing firm-wide billing practices and client payment policies.

Good law firm cash flow starts with timely billing: every lawyer in the firm must submit billable hours regularly, and bills should go out to clients on a regular basis, so that everyone knows what to expect.

Set clear billing policies and communicate them to every new client at the start of the relationship. One way to improve cash flow is to shorten your payment terms, even by as little as 15 days.

Billing software can make a huge difference in the efficiency of your collections. Follow up on client payments by emailing invoices, checking open rates quickly, and placing a timely reminder phone call. Don’t wait until the payment is due to find out a client hasn’t even opened a bill. A thirty-day delay on an unpaid invoice will have a measurable impact on your cash flow.

For clients who are regularly slow to pay, instituting retainers can help improve the cash flow curve.

On the employee side, audit your internal policies around billing and streamline as needed. For employees who are slow to bill, try tying compensation to their billing habits. Few things inspire better behavior than financial incentive.

Mistake #5: Ignoring Forecasted Revenue and Expenses

Solution: Manage your budget at least monthly (partner distributions included).

There’s one thing every successful law firm has in common: They review and update their cash flow forecast on a regular basis. If you create a forecast and don’t touch it for an entire year, it’s not really a forecast.

That’s like using a paper map for a road trip, rather than turning on your GPS. You might choose to introduce a new service line, a once-in-a-lifetime talent could become available, or you could lose a major client to an acquisition.

A forecast that is never updated will not leave room for these changes. A dynamic forecast can help you gain real time insights into your law firm finances.

This is just a high-level overview of one of the metrics of profit-focused accounting: cash. To get the whole picture, sign up to receive the book I wrote, Judicial Dollars and Cents, where I answer questions including:

- How much cash do you need in reserve (and how do you know if it’s enough)?

- How can four levers help you maximize your firm’s revenue?

- Is your firm working as efficiently as possible or is there room for improvement?

- How full is your client pipeline and how does that impact revenue and hiring decisions?

Learn more about our Virtual CFO services for law firms below.