The Tax Cuts and Jobs Act has made several sweeping changes to different areas of the tax law. As trusts and estates are subject to substantially the same tax rules as individuals, many of the changes that impact individuals will also impact trusts.

Keep in mind that the new planned tax off-sets, such as increased standard deduction and child tax credits, put in place for individuals will not benefit trusts in the same manner. Below we outline tax reform changes that will directly impact trusts and estates.

Rate Reduction

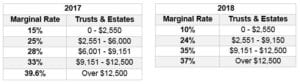

The tax rate brackets for trusts have historically been extremely compressed compared to the individual tax brackets. This remains true, but the new tax law combines the 25% and 28% tax brackets into one 24% tax bracket, bringing the total amount of brackets from five to four. Below is the comparison of the 2017 and 2018 ordinary trust tax rates:

Alternative Minimum Tax

The tax law did not change the AMT exemption and phase-out thresholds for trusts. The exemption remains at $24,600 with a phase-out threshold of $82,050, subject to adjustments for inflation.

State Tax Deduction

Similar to the individual tax changes, the aggregate of state real property and income tax expenses deductions will be capped at a maximum of $10,000.

Miscellaneous 2% Deductions

Under the previous tax code, trusts were allowed miscellaneous deductions that exceeded 2% of AGI which included investment advisory fees. Under the new law, these deductions are repealed. It will be more important to consider which fees are incremental costs of administering a trust as these deductions are still allowed under the new tax law.

Accounting, Legal and Trustee Fees

These deductions have been scrutinized as they were not specifically mentioned in the new tax law. It is believed that these deductions will still be fully deductible to the extent that the expense “would not have been incurred if the property were not held in such trust or estate.”

Section 199A Deduction

If a trust or estate owns a business held as a sole proprietorship or as a pass-through entity, such as a partnership or S-corporation, including ESBT income, then the trust may qualify for the new 20% deduction on domestic qualified business income with additional limitations. The thresholds to determine the potential deduction are the same the thresholds for single taxpayers. This calculation can be complex, and it is advised to speak with a tax professional to determine deductibility.

Simple Trusts – Income Distribution Deduction

Although the Tax Cuts and Jobs Act did not specifically change the rules to determine the Income Distribution Deduction (IDD), simple trusts may find an increase in trust level tax as a result of the limited deductions increasing Distributable Net Income (DNI) without a similar increase in Fiduciary Accounting Income (FAI) since the IDD is limited based on the smaller of DNI or FAI.

Electing Small Business Trusts

The new tax law also makes two specific changes for Electing Small Business Trusts (ESBTs) relating to beneficiaries and charitable contributions. ESBTs are now allowed to have nonresident alien individuals as beneficiaries. ESBTs must now follow the same rules as individuals to determine the deductible charitable contributions and excess contributions can be carried forward for use in future tax years. Previously, ESBTs were allowed a 100% deduction made from the gross income of the S-Corporation, but now limitations based on AGI of the ESBT income apply.

Estates and Gift Tax

The new tax law did not repeal the estate and gift tax, but it did increase the exemption for an individual from $5.49 million to $11.18 million. The step-up in basis for property passing to heirs at death also remains in place.

Contact an Anders advisor with questions specific to your tax situation.