The Missouri Works Program was created to assist in establishing quality jobs through targeted business projects. The program allows businesses to save on state withholding tax for new jobs and/or receive state tax credits, based on a percentage of payroll of the new jobs. There are five different programs that applicants may apply for under the Missouri Works Program: Zone Works, Rural Works, Statewide Works, Mega Works 120, and Mega Works 140. Each program varies by the criteria required to participate.

Eligibility Requirements

The benefits of the program are not provided until the minimum new job threshold is met, and the company meets the average wage and health insurance requirements. To be considered a new job, the position must be full-time (35 or more hours per week) and for whom the company offers/pays 50% of health insurance. New jobs are based on the increase from the “base employment”. “Base employment” is the greater of (a) the number of full-time employees on the date of the Notice of Intent, or (b) the average number of full-time employees for the 12 month period prior to the date of the Notice of Intent. If the company reduces jobs at another facility in Missouri with related operations, the new jobs at the project facility would be reduced accordingly.

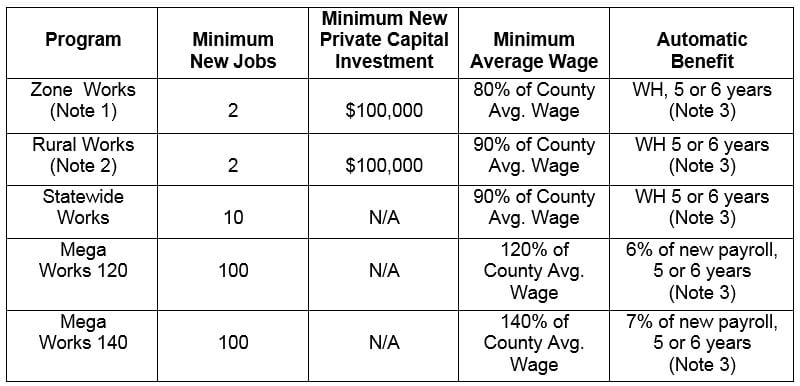

Below is a chart with the benefit eligibility requirements for each program.

“WH” means the retention of state withholding tax of the new jobs.

Note 1: Project facility must be located in an Enhanced Enterprise Zone.

Note 2: Project facility must be located in a “rural” county, which would NOT include Boone, Buchanan, Clay, Greene, Jackson, St. Charles, and St. Louis City and County.

Note 3: Benefit period is 5 years, or 6 years for existing Missouri Companies (those that have been operational in Missouri for at least 10 years).

Discretionary Benefits

In addition to the automatic benefits listed above, the Statewide Works or Mega Works projects may be considered for discretionary benefits, limited to the net state fiscal benefit. Eligibility depends upon:

- The least amount necessary to obtain the company’s commitment;

- The overall size (number of jobs, payroll, new capital investment) and quality (average wages, growth potential of the company, multiplier effect of the industry) of the project;

- The financial stability and creditworthiness of the company;

- The level of economic distress of the project area;

- The competitiveness of alternative locations; and

- The percent of local incentives committed to the project.

Prior to the receipt of a Department of Economic Development (DED) proposal or approval of Notice of Intent (NOI), none of the following can have occurred:

- Significant, project-specific site work at the project facility.

- Purchased machinery or equipment related to the project.

- Publicly announced its intention to make new capital investment at the project facility.

For more information on the Missouri Works program and to find out if you qualify, contact an Anders advisor.