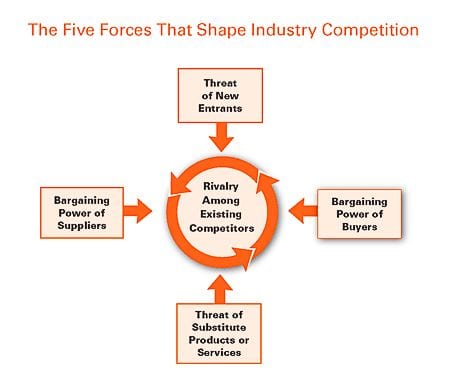

In 1979, Professor Michael E. Porter published “How Competitive Forces Shape Strategy” in the Harvard Business Review. Thirty-five years later, the framework developed by Professor Porter is still being used by business valuators to assess the competitive position of an industry in which a business operates. The framework is based on the theory that there are five forces (as seen in the diagram below) that shape the competitive intensity and attractiveness of an industry.

Rivalry Among Existing Competitors – Companies compete in a number of different ways, such as price, product innovation, and service. As competition within the industry increases, profitability tends to decrease as businesses are forced to spend money in order to maintain, or compete for, market share. The more rivalry there is among existing competitors, the less attractive the industry will be to an investor looking to purchase a business operating within the industry.

Threat of New Entrants – Industries that are profitable tend to attract new entrants. As the number of businesses competing within an industry increases, the profitability per business tends to decrease. The threat of new entrants is lowest for those industries that have significant barriers to entry, such as major capital requirements, burdensome government regulations, or significant intellectual property. Industries with high barriers to entry tend to be more profitable, and therefore more attractive in the eyes of an investor.

Threat of Substitute Products or Services – The threat of substitute products or services limits the price that a business can charge. Industry profitability will suffer when there are many substitute products available in the market. This is especially true when the customer’s cost of switching to the substitute product or service is low. Industries that produce products or provide services for which there is no substitute tend to be the more profitable, and therefore more attractive to investors.

Bargaining Power of Suppliers – When there are a limited number of suppliers supporting an industry, the bargaining power shifts away from the industry participants (i.e., the customers) and in favor of the suppliers. This shift in bargaining power allows the suppliers to increase their profitability through various means, including increasing prices, limiting the quality and service to be provided, and shifting costs from the supplier to the industry participants. Accordingly, industries in which the suppliers have the bargaining power tend to be less profitable, and therefore less attractive to investors.

Bargaining Power of Buyers – Just like with suppliers, when there are a limited number of buyers, the bargaining power tends to shift to the buyers. Industries in which there are a limited number of buyers tend to be less profitable as the buyer can force prices down and demand better quality and service, which drives costs up.

The competitive position of the industry in which a business operates can have a significant impact on the value of the business and the attractiveness of the business to an investor. If you would like some assistance in assessing the competitive position of your industry, please contact a member of the Forensic and Valuation Services Group at Anders.