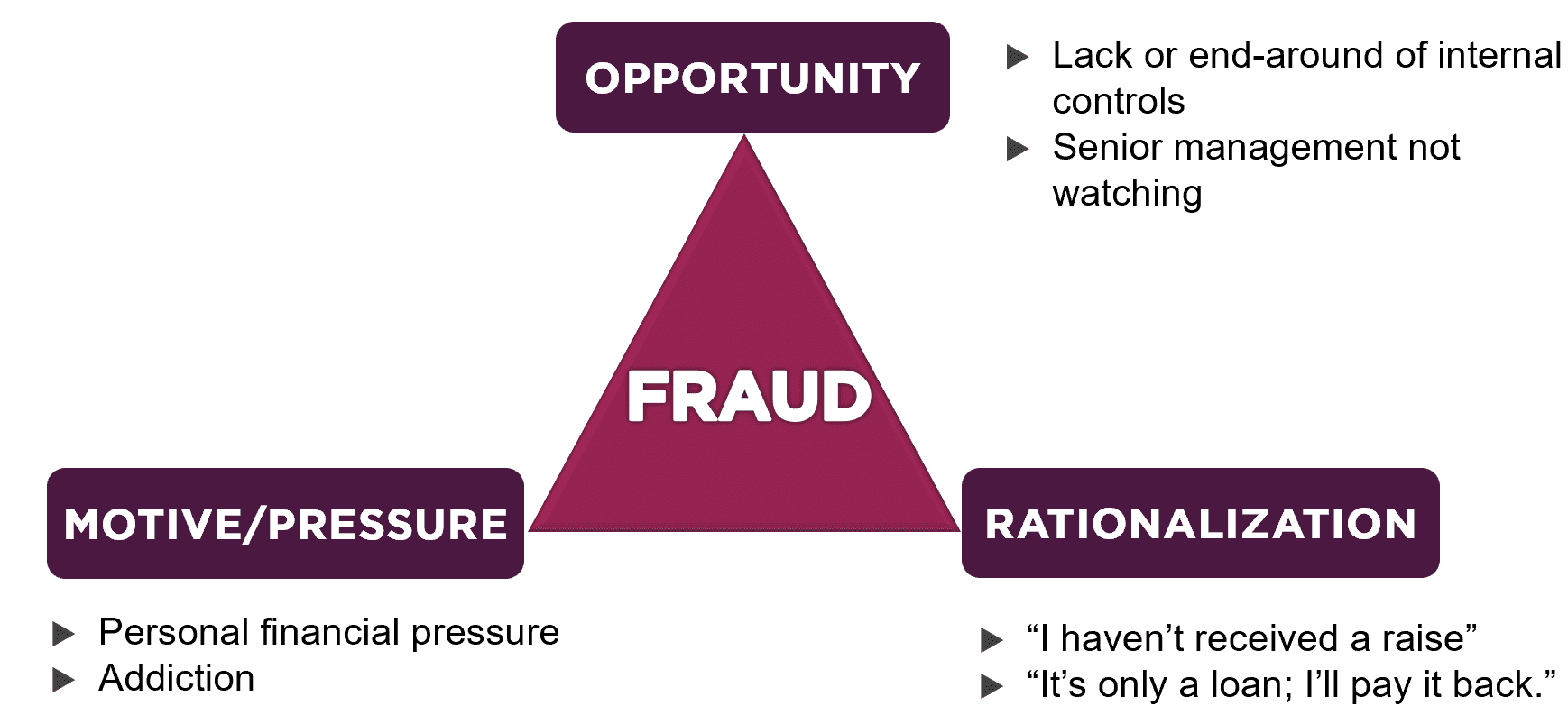

In order to deter, detect and investigate fraud, one must understand how and why people commit fraud. Knowing the “how” helps managers and business owners create policies and design internal controls to reduce the occurrence of fraud. The “why” is more nuanced, but it is just as important in understanding fraud.

The fraud triangle has endured through the decades as a metaphorical diagram to assist us in understanding and analyzing fraud. The concept states that there are three components which, together, lead to fraudulent behavior. They are (1) a perceived un-shareable financial need (motive/pressure), (2) a perceived opportunity to commit fraud, and (3) the rationalization of committing the fraud.

The “How”

The “opportunity” element of the fraud triangle refers to the circumstances that allow fraud to occur. Without it, fraud becomes impossible. This is the only component of the fraud triangle over which the company exercises significant, or in some circumstances complete, control.

According to the ACFE’s 2020 Report to the Nations, 35% of reported fraud cases arise in organizations that lack internal controls. However, it is important to understand that even in organizations with a robust control environment, fraud is possible if employees circumvent controls. This can be accomplished in a number of ways, including collusion among employees or a lack of adequate management review.

Far too many fraud cases come to us where an employee was placed in a position of complete trust, only to betray the trust of his or her employer. A well-designed system of internal controls paired with strong “tone at the top” and management oversight are the best ways for a company to reduce fraud “opportunity”. And remember, trust is NOT an internal control!

The “Why”

Whether referred to as pressure, motive, or incentive, another key element of fraud is a perceived, usually unshareable, financial need on the part of the fraud perpetrator. It is the reason why a person commits fraud.

There is a nearly endless list of reasons a person would feel compelled to commit fraud. It could be personal financial problems, such as mounting medical bills, gambling debts or a spouse laid off from their job, employee’s compensation tied to financial performance, or good old fashioned greed. The reason the employee commits fraud can also evolve over time. For example, several of the fraud investigations we have worked on began with an employee embezzling funds to take care of a personal financial problem and then changed to greed once the financial hardship had been resolved.

Companies can help alleviate some of this pressure by providing programs where employees can seek anonymous help in their time of need. These programs can range from providing resources for a person battling addiction, to setting achievable, realistic goals for compensation purposes based on input from the employee. Management should always seek to be “in-tune” with the needs of their employees as much as possible.

How Do Fraudsters Sleep at Night?

Rationalization of committing fraud is the most difficult condition to observe because it takes place in the mind of the perpetrator. Rationalization involves fabricating a moral excuse to justify the fraud. Many fraudsters view themselves as honest, ordinary people and not as criminals, so they have to come up with some reasoning to reconcile the act of committing fraud with their own personal code of ethics. Some common rationalization statements are, “I’ll just take this money now and pay it back later,” “No one will notice,” or “I deserve this after all these years with this company.” Some fraudsters rationalize their behavior by re-framing their definition of wrongdoing to exclude his or her actions. In certain rare cases, fraudsters may seem to abandon their moral code entirely.

The Perfect Storm

The convergence of these three conditions: pressure, opportunity and rationalization, form a high-risk environment ripe for fraud. Each element interacts with the others. While an employee may have a high degree of financial pressure, they will not commit fraud if there is no perceived opportunity or if the risk of detection is too high. Meanwhile a sufficiently compensated, content employee with little financial pressure is not likely to commit fraud, even if they may have the opportunity to do so. Similarly, a person who perceives an opportunity to misrepresent financial statements and has the incentive to commit the fraud is unlikely to do so if he or she knows it is wrong and cannot rationalize the fraud. However, as the pressure to commit fraud increases, a potential fraudster may begin to see more opportunities to circumvent controls, and may begin to rationalize these behaviors in their head. Keeping the fraud triangle conditions in mind can help managers and business owners minimize the risk of fraud in their organizations.

If you have any questions on preventing fraud in your organization, or suspect fraud may have already occurred at your organization, please contact an Anders advisor below. Learn more about Anders Forensic, Valuation and Litigation services.

All Insights