Virtual CFO

Our team of fully remote, industry-focused virtual CFOs offer the comprehensive financial reporting and forecasting your business needs to grow and thrive.

Virtual CFO Services for Small to Mid-Sized Businesses

Summit Virtual CFO by Anders allows you to outsource your CFO and accounting needs. A Virtual CFO can provide the following services: manage bank relationships, weekly meetings, business forecasting, company-wide KPIs, and more, all at a fraction of the cost of a full-time CFO. Our average VCFO package costs $78,000 per year.

We’re industry-focused to help you succeed. Our advisors have deep industry expertise to understand the nuances of your business. Learn more about our process and pricing for your industry:

Service Levels to Meet Your Needs

Level 1: Virtual CFO

Our Virtual CFO service provides year-round strategy by partnering you with a Virtual CFO and a remote accounting team. The Virtual CFO, your main point of contact, will teach you forecasting through non-financial metrics. They’ll monitor those metrics to reduce risk and increase profit, while building your cash reserves to 10% of revenue. A senior accountant handles day-to-day questions and assists with analysis and planning, while the tax specialist works behind the scenes, consulting as necessary to ensure no end-of-year surprises.

In addition to benefiting from our leading-edge tech stack, you’ll get a team with diverse expertise and significant redundancy to ensure nothing ever stops (even when someone is sick or takes a vacation) – all at a fraction of the cost of a full-time employee.

If you have a growing business that needs professional financial advice (20+ employees / $5 million+ in annual revenue) but can’t afford a full-time CFO or controller, our Virtual CFO service is a perfect fit.

Level 2: Controller

Our Controller service partners you with a Controller and a remote accounting team. The Controller, your main point of contact, works with you proactively on strategic cash flow management and dynamic forecasting—a critical component of future growth. Your team also includes a senior accountant who handles day-to-day questions and assists with analysis and planning, and a tax specialist who works behind the scenes and consults as necessary to ensure no end-of-year surprises.

In addition to benefiting from our leading-edge tech stack, you’ll get the benefits of a team with diverse expertise and significant redundancy to ensure nothing ever stops (even when someone is sick or takes a vacation) – all at the fraction of the cost of a full-time employee.

If you’re a growing business that needs professional financial advice but can’t afford a full-time Controller, our Controller service is a perfect fit.

Level 3: Transactional

Our Transactional service helps lay a solid financial foundation on which your business can grow. We prepare your monthly financial statements—including balance sheets, industry financial comparisons, and more. But we’re not just a team of bookkeepers and accountants; we are ready to provide the strategic planning required to help your business accelerate when you need it.

If you’re a growing business that needs professional financial advice, our Transactional service is a perfect fit.

Add-On Services

The following à la carte services can be added to any of our three levels:

Paying Bills (Accounts Payable)

Invoicing Clients (Accounts Receivable)

Payroll Management

Cash Flow Management

Credit Card Receipt Tracking

Business and Personal Tax Returns

Our Process

Our process starts with onboarding. Our team works hard during onboarding to get caught up with your existing processes. We look at your past books, build a forecasting model and set of KPIs, and perform a detailed review of your financial statements/chart of accounts to make sure we’re all on the same page and getting started on the right foot. Note: During the onboarding period, our normal weekly fee is doubled to cover the additional resources and effort needed to get up to speed in a timely manner.

How we work together after onboarding: Each service level has a different meeting cadence. After an initial onboarding period, a typical month might include:

If we are paying bills as part of the engagement, we will also meet weekly with one individual team member for about 15-30 minutes to go over cash flow for the next six to 13 weeks. We find that this schedule works best for most clients, but it is tailored to fit your needs. Regardless of the level of service you choose, we are always available anytime for questions, calls, and impromptu meetings.

How much does a Virtual CFO cost?

Our pricing policy is fixed. Your quote is not an estimate.

Our team discovers what your needs are and then uses specific criteria to itemize a set price. When you receive a quote from us, this price is all-encompassing, and unless circumstances change, there will be no hidden costs or miscellaneous fees. We price weekly because we are truly a member of your team, not simply another vendor you work with. Your employees won’t increase their rates like a vendor might, and neither will we. We’re not a traditional accountant that you see once per quarter or once per year – we’re an extension of your team! Schedule a consultation below to learn more about our pricing.

*The average price scales based on revenue and employee count. Final pricing takes into account these factors and a la carte services added on by the client. Pricing has been updated as of 2/21/2023.

TRANSACTIONAL

Ideal for small businesses with fewer than 10 employees, our Transactional package provides the essential financial services you need. Get access to our leading-edge tech stack, a remote accounting team, and unlimited online support. We handle your month-end close and provide financial statements to keep your business on track.

What's Included:

-

Services for Small Companies (Up To 10 Employees)

-

Reactive Financial Services

-

2 Week Onboarding Period

-

1 Meeting per Month

-

Unlimited Online Support

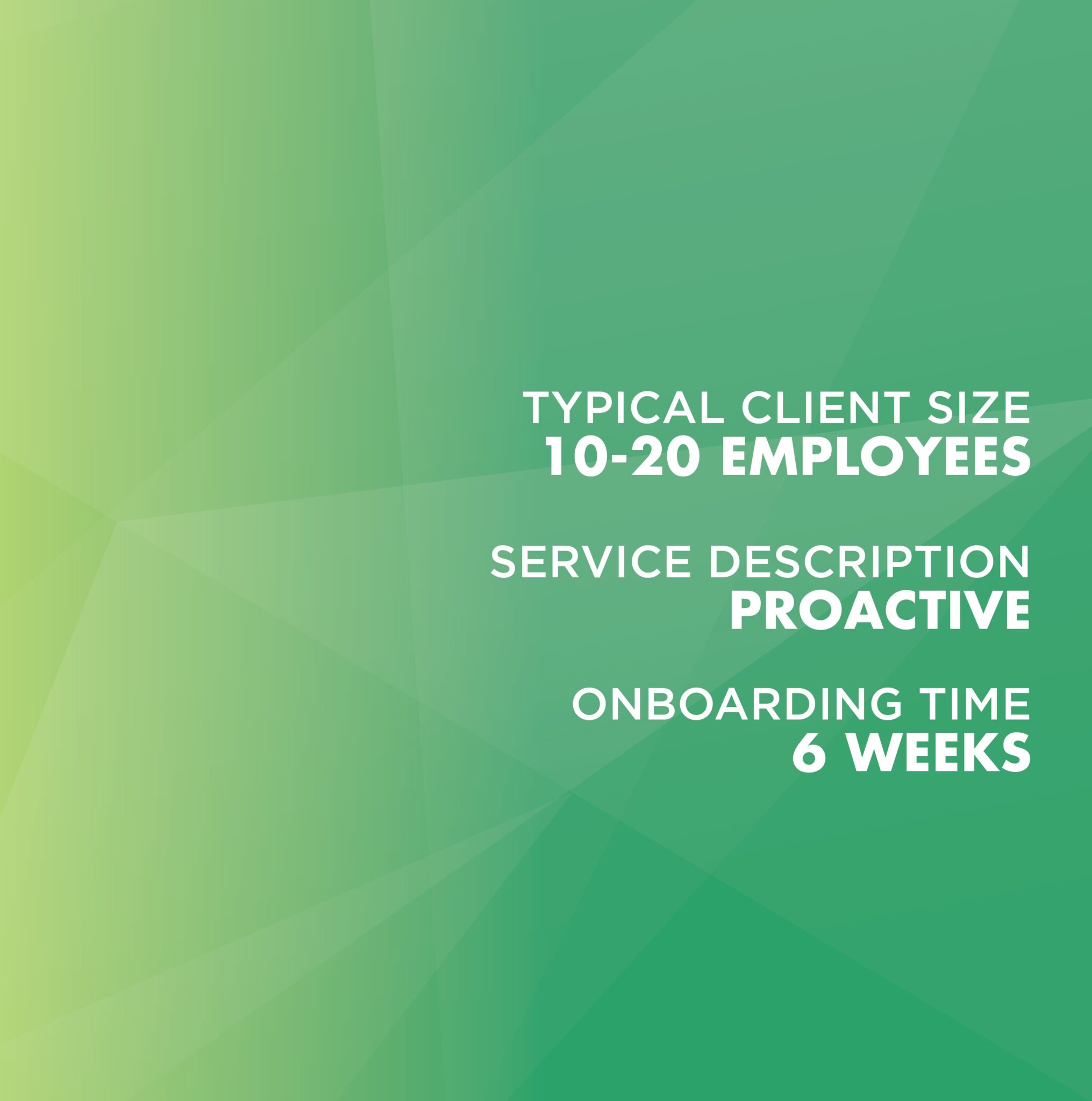

CONTROLLER

Designed for medium-sized businesses with 10-20 employees, our Controller package offers proactive financial services. In addition to the Transactional package services, you’ll benefit from company-wide KPIs, 12-month forecasting, and revenue recognition. We also offer up to 2 scheduled meetings per month for detailed financial discussions.

What's Included:

-

Services for Medium-Sized Companies (10-20 Employees)

-

Proactive Financial Services

-

6 Week Onboarding Period

-

Up to 2 Meetings per Month

-

Unlimited Online Support

-

Month-End Close

-

Financial Statements

-

Company-Wide KPIs

-

12-Month Forecasting

-

Revenue Recognition

VIRTUAL CFO

Ideal for larger businesses with 20+ employees and $5 million+ in annual revenue, our Virtual CFO package partners you with a Virtual CFO for forecasting, risk reduction, and profit increase strategies. Enjoy comprehensive financial services, performance tracking, and weekly leadership meetings.

What's Included:

-

Services for Large Companies (20+ Employees)

-

Strategic Financial Services

-

8 Week Onboarding Period

-

Up to 6 Meetings per Month

-

Unlimited Online Support

-

Month-End Close

-

Financial Statements

-

Company-Wide KPIs

-

12-Month Forecasting

-

Revenue Recognition

-

Incentive Plans

-

Performance by Project

-

Team Member Performance

-

Department Performance

-

Customized Dept. Reports

-

Bank Relationships